Zero-Emission School Bus and Infrastructure (ZESBI)

The Zero-Emission School Bus and Infrastructure (ZESBI) incentive project pairs zero-emission school bus vehicle incentives through the California Air Resources Board (CARB), with charging infrastructure incentives through the California Energy Commission (CEC). A total of $500 million is appropriated from Senate Bill (SB) 114 for ZESBI. In Fiscal Year 2023-24, $375 million is allocated to support purchases of qualifying zero-emission (ZE) school buses and $125 million is allocated to support infrastructure and associated cost incentives.

ZESBI Application Insights

ZESBI received applications representing approximately $690M in maximum funding requested for new zero-emission school buses, along with associated infrastructure and related costs, exceeding the total program funds of $500M.

Applicant Eligibility

All applicants must serve students within the K-12th grade levels. Eligible entities include:

- California Public School Districts

- California Public Charter Schools*

- California Joint Power Authorities (JPAs)

- California County Offices of Education (COEs)

*Charter schools classified as a non-classroom based charter school as of FY 2021-22 are not eligible entities. Private schools are also not eligible entities.

For more information, see Page 6 of the CARB’s ZESBI Implementation Manual.

Old School Bus Eligibility Requirements

Participation in ZESBI requires the scrappage of an old school bus for each zero-emission school bus and charger requested. The old school bus can be any internal combustion engine using any fuel type (gasoline, diesel, propane, or compressed natural gas). The eligibility requirements for the old school bus(es) are:

- The school bus chassis must be a 2010 model year or older. The school bus chassis age is verified by the model year listed on the DMV Registration Form.

- The school bus must be Applicant owned. The school bus cannot have a lienholder listed on the DMV Registration Form.

- The school bus must have a Gross Vehicle Weight Rating (GVWR) greater than 10,000 pounds. School bus(es) with a GVWR of exactly 10,000 pounds or less than 10,000 pounds are not eligible.

- The school bus must have a current California Highway Patrol Safety Certification (CHP 292 or equivalent) at the time of Application Part A submission. A non-certified school bus will not be able to continue within the application process.

- If a school bus is diesel-fueled and greater than 14,000 pounds GVWR, the school bus must be compliant with the California Truck and Bus Regulation in order to receive a full incentive amount. In cases where the old school bus is not compliant, a $20,000 incentive deduction will be applied per non-compliant school bus.

For more information, see Page 10 of the CARB’s ZESBI Implementation Manual.

Application Prioritization

Applicants within each tier (Tiers 1 – 3) will be ranked based on the timestamp of submission of their complete Application Part A. The timestamp on any application that is missing materials or otherwise deemed incomplete will not be recorded until all application materials are submitted.

Disadvantaged Community (DAC) and Low Income Community (LIC) designations will be applied using the California Climate Investments Priority Populations map, located online at https://webmaps.arb.ca.gov/PriorityPopulations/.

| Priority Tier | Defined as…. |

| Tier 1 |

|

| Tier 2 |

|

| Tier 3 |

|

For more information, see Page 8 of the CARB’s ZESBI Implementation Manual.

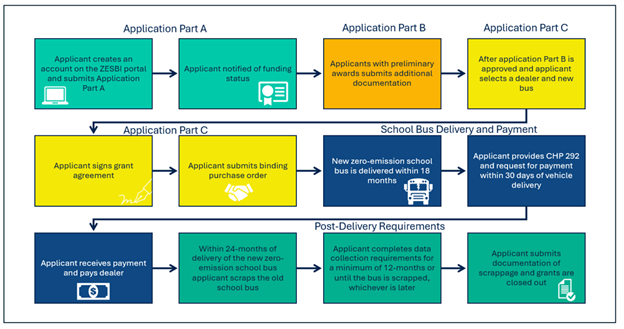

Application Process

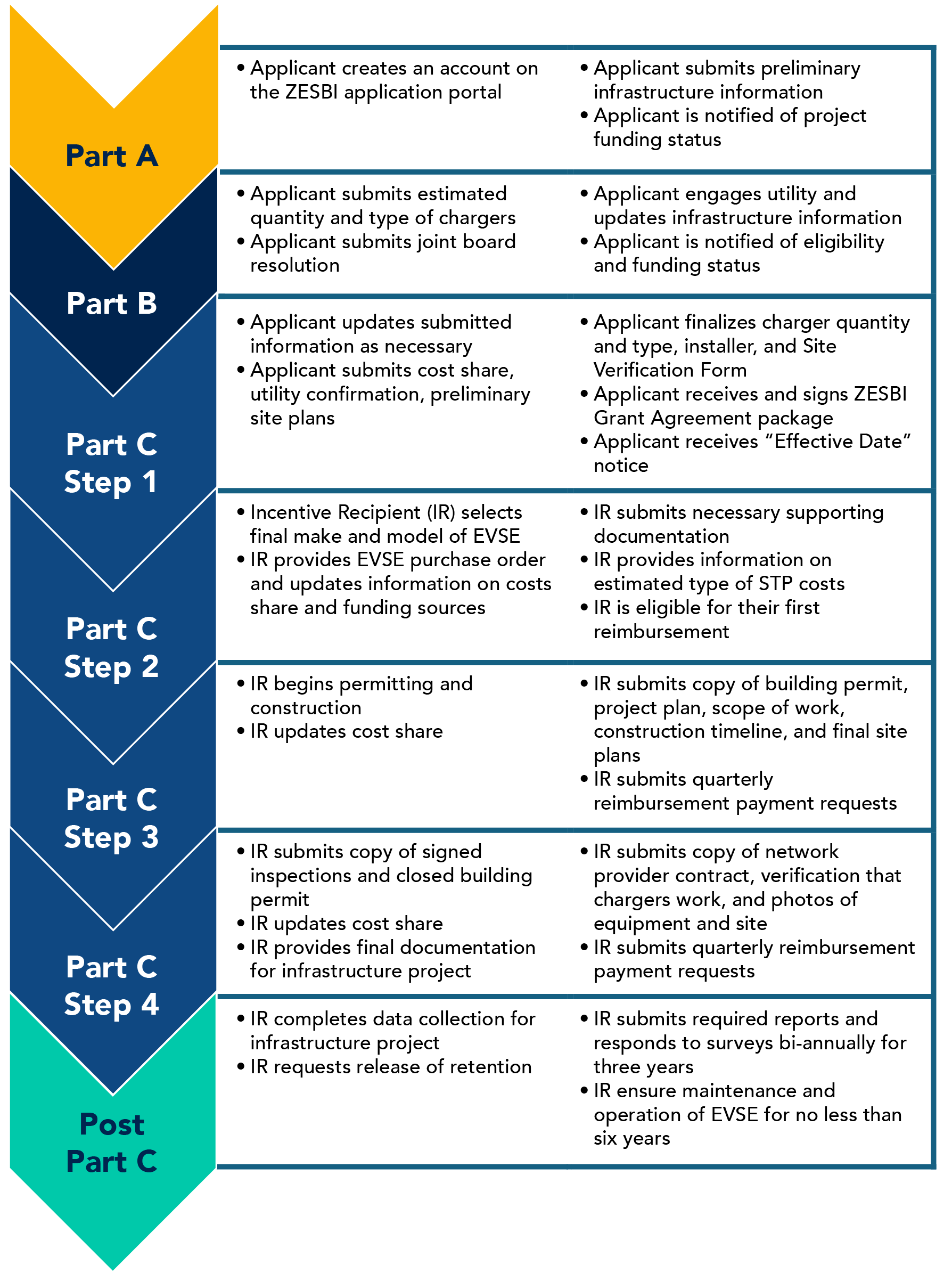

Local educational agencies (LEAs) are required to create an account in the application portal to apply for ZESBI in Application Part A. Applicants who are preliminarily awarded funding during Part A will move on to Application Part B and provide additional documentation. Once all Application Part B submissions are reviewed and funding is reserved, Applicants will be notified of the next steps to complete Application Part C – Step 1. At this stage, Applicants will select their new zero-emission school bus type and final charger quantity and type(s).

This process will repeat through Application Part C – Step 4. During review periods between each application stage, Applicants will be notified of any necessary corrections to be made, and they must respond to these corrections within 30 calendar days of notification. Please note that funding does not become binding until a Grant Agreement is signed and a purchase order is submitted in Application Part C – Step 1.

Vehicle Timeline

Infrastructure Timeline

For more information on the school bus application process, see Page 12 of the CARB’s ZESBI Implementation Manual.

For more information on the infrastructure application process, please see Section 8 of CEC’s Implementation Manual.

Incentives

ZE School Bus Maximum Incentive Amounts

| School Bus Type | Without a wheelchair lift | With a wheelchair lift |

| Type A | $280,000 | $295,000 |

| Type C | $340,000 | $355,000 |

| Type D | $360,000 | $375,000 |

*To view ZESBI eligible zero-emission school buses and their respective incentive amounts, visit the HVIP Vehicle Catalog.

Infrastructure Incentive Amounts

| Charger Type | Maximum Infrastructure Amount |

| Level 2 (L2) | $20,000 |

| Direct Current Fast Charger (DCFC) or DCFC Bi-directional* | $75,000 |

* An Incentive Recipient will be eligible for up to $95,000 for the first bidirectional DCFC requested. All remaining bidirectional DCFC requested after the first bidirectional DCFC will be eligible for up to $75,000 each.

Example: If an Applicant requests three ZE school buses, and three bidirectional DCFC ($95,000 + $75,000 x 2), the Applicant would be eligible for a maximum infrastructure award amount of $245,000.

Local Educational Agencies can receive up to one ZESBI-funded charger for each ZESBI-funded bus that is awarded.

Infrastructure

Procurement Costs

- EVSE, including L2 and DCFCs.

- One-time network and software costs for at least the term of the agreement or at most six years after commissioning.

- Equipment capable of V2G bidirectional charging (eligible but not required).

- ZE Mobile Chargers

- An Applicant must provide sufficient information as to why a mobile charger is needed (example: utility delay) for this to qualify under the Procurement rather than the Other Costs category.

- A mobile charger cannot replace a permanent charger(s).

- An Applicant must be able to verify that costs for permanent chargers and installation will be fully covered before spending funds on a mobile charger.

- Non-zero emission generators are not allowed for the purpose of powering mobile chargers procured with ZESBI funds.

- Sales tax

- Related to the purchase of procurement costs up to the maximum grant amount.

Installation Costs

- Project management (see note about soft costs below).

- Site design (see note about soft costs below).

- Site upgrades (transformers, breakers, stub outs, switchgear, meter mains, and circuit breaker panels).

- Utility service upgrades and stub outs are allowable for future EVSEs.

- Utility programs that reimburse service upgrades and integration costs may be utilized for ZESBI projects but are not eligible to be reimbursed with ZESBI funds.

- Technical assistance

- Consulting services including but not limited to:

- Vehicle/charger selection

- Infrastructure design

- Electric utility connections

- Fleet operation and maintenance

- Please note, compliance planning assistance for the Advanced Clean Fleets Regulation is not an eligible expense under ZESBI.

- Consulting services including but not limited to:

- Sales tax

- Related to the purchase of installation costs up to the maximum grant amount.

Other Costs*

- ZE distributed energy resources, such as battery energy storage systems (BESS) and/or solar photovoltaics (PV)

- Baseline product warranty (included with product) or extended equipment product warranty for up to six years post commissioning.

- ZE mobile chargers.

- Sales tax

- Related to the purchase of other costs up to the maximum grant amount.

*Incentive awards for eligible “Other Costs” shall only be paid once, after site commissioning, with the final invoices. Monthly service fees are not eligible for incentives through ZESBI.

For more information, See page 20 of the CEC’s ZESBI Implementation Manual.

School Transportation Program Funding

At least 90% of the grant award is to be spent on ZE school buses, supporting charging infrastructure and associated costs. At most 10% of the grant award can be spent on the Incentive Recipient’s school transportation program.

The School Transportation Program funding can only be used to supplement expenses from an Incentive Recipient’s transportation department. It cannot be used to supplement any other area or department.

All costs must be incurred WITHIN the Effective Date of an Incentive Recipient’s Grant Agreement Term. Please see page 23 of CEC’s ZESBI Implementation Manual for more information.

Eligible costs include:

| Transportation Department | Including but not limited to… |

| Infrastructure | Charger Upgrades/Repairs Fuel Costs (electricity or hydrogen ONLY) |

| Transportation Vehicles (Owned & Operated by the Incentive Recipient) | ZE School Bus Repairs (outside warranty) Charging Management/V2G Management Services |

| Transportation Yards | New Fencing/Refencing

New Pavement/Repavement |

| Transportation Department Buildings | Office Equipment (Computers, Printers, Software)

Security Cameras and Systems |

| Transportation Department Electrical System | Electrical System Upgrades to Transportation Yards |

| Transportation Department ZE Workforce Training | Incentive Stipends for Completion of the CEC’s Electrical School Bus Training Program. Maximum amount per person will be determined at a later date.

Maintenance Equipment Used for Training |

| Transportation Shop Equipment | Auto Repair Tools for ZE School Buses

EVSE/Diagnostic Equipment High Voltage Safety Equipment/ Supplies for ZE School Buses |

Resources

-

- CEC’s ZESBI Implementation Manual

- CEC’s ZESBI Infrastructure Fact Sheet

- CEC ZESBI Webpage

- ZESBI Approved Product List

- October Installation Partners List

- Infrastructure Insight Tool

- Infrastructure Planning Guide

- SCE’s School District Fleet Electrification Learning Session Recording

- SCE’s School District Fleet Electrification Learning Session Slide Deck

FAQs

ZESBI’s first application window opened on May 14, 2024, at 10:00 am Pacific Daylight Time and closed on September 30, 2024, at 5:00 pm Pacific Daylight Time. ZESBI’s second application window opened on October 8, 2024, at 10:00 am Pacific Daylight Time and closed on November 22, 2024, at 5:00 pm Pacific Standard Time.

All applicants must serve students within the K-12th grade levels.

Eligible entities include:

- California Public School Districts

- California Public Charter Schools*

- California Joint Power Authorities (JPAs)

- California County Offices of Education (COEs)

*Charter schools classified as a non-classroom-based charter school as of FY 2021-22 are not eligible entities.

Private Schools are not an eligible entity.

Public school districts in California that own their own school buses are eligible to participate. This includes public school districts that own their school buses but contract with a County Office of Education or private contractor for maintenance and operations. Where two or more public school districts have formed a Joint Powers Authority (JPA), and the JPA holds ownership of the school buses, the JPA is eligible to participate. JPAs may use their highest priority criteria school district to serve as the basis for eligibility. Public charter schools that own their own school buses and County Offices of Education that own their own school buses are also eligible to participate.

Incentive amounts, as shown in the table below, intend to cover nearly, if not all, the full cost of a new zero-emission school bus.

Maximum Incentive Amounts

| School Bus Type | Without a wheelchair lift | With a wheelchair lift |

| Type A | $280,000 | $295,000 |

| Type C | $340,000 | $355,000 |

| Type D | $360,000 | $375,000 |

*To view ZESBI eligible zero-emission school buses and their respective incentive amounts, visit the HVIP Vehicle Catalog.

Eligible Costs include:

- Zero-emission school bus

- Taxes

- Shipping and delivery fees

- Document Preparation Fees

- Recycling fees

- California Tire fees

- DMV Filing fees

Ineligible Costs include, but are not limited to:

- Training

- Extended Warranties

- Scrappage fees

- Local Governmental Agencies Incentive Fees

- Any price increases after initial purchase order is submitted, including but not limited to, bus price increases and tax rate increases.

- Maintenance and Repairs needed for the new zero-emission school bus(es)

- Cost of delayed payments to Approved HVIP dealers for school buses

Eligible applicants who apply for ZESBI will be eligible for two awards: one for new zero-emission school bus(es) and one for the complementary infrastructure and associated costs. Local Educational Agencies can receive up to one ZESBI-funded charger for each ZESBI-funded bus that is awarded. Local Educational Agencies cannot receive infrastructure funding without a ZESBI-funded school bus.

Award Amount Per Charger

| Charger Type | Maximum Infrastructure Amount |

| Level 2 (L2) | $20,000 |

| Direct Current Fast Charger (DCFC) or DCFC Bi-directional* | $75,000 |

* An Incentive Recipient will be eligible for up to $95,000 for the first bidirectional DCFC requested. All remaining bidirectional DCFC requested after the first bidirectional DCFC will be eligible for up to $75,000 each.

Example: If an Applicant requests three ZE school buses, and three bidirectional DCFC ($95,000 + $75,000 x 2), the Applicant would be eligible for a maximum infrastructure award amount of $245,000.

Procurement Costs

- EVSE, including L2 and DCFCs.

- One-time network and software costs for at least the term of the agreement or at most six years after commissioning.

- Equipment capable of V2G bidirectional charging (eligible but not required).

- ZE Mobile Chargers

- An Applicant must provide sufficient information as to why a mobile charger is needed (example: utility delay) for this to qualify under the Procurement rather than the Other Costs category.

- A mobile charger cannot replace a permanent charger(s).

- An Applicant must be able to verify that costs for permanent chargers and installation will be fully covered before spending funds on a mobile charger.

- Non-zero emission generators are not allowed for the purpose of powering mobile chargers procured with ZESBI funds.

- Sales tax

- Related to the purchase of procurement costs up to the maximum grant amount.

Installation Costs

- Project management (see note about soft costs below).

- Site design (see note about soft costs below).

- Site upgrades (transformers, breakers, stub outs, switchgear, meter mains, and circuit breaker panels).

- Utility service upgrades and stub outs are allowable for future EVSEs.

- Utility programs that reimburse service upgrades and integration costs may be utilized for ZESBI projects but are not eligible to be reimbursed with ZESBI funds.

- Technical assistance

- Consulting services including but not limited to:

- Vehicle/charger selection

- Infrastructure design

- Electric utility connections

- Fleet operation and maintenance

- Please note, compliance planning assistance for the Advanced Clean Fleets Regulation is not an eligible expense under ZESBI.

- Consulting services including but not limited to:

- Sales tax

- Related to the purchase of installation costs up to the maximum grant amount.

Other Costs*

- ZE distributed energy resources, such as battery energy storage systems (BESS) and/or solar photovoltaics (PV)

- Baseline product warranty (included with product) or extended equipment product warranty for up to six years post commissioning.

- ZE mobile chargers.

- Sales tax

- Related to the purchase of other costs up to the maximum grant amount.

*Incentive awards for eligible “Other Costs” shall only be paid once, after site commissioning, with the final invoices. Monthly service fees are not eligible for incentives through ZESBI.

For more information, See page 20 of the CEC’s ZESBI Implementation Manual.

No, infrastructure incentives are based on the total number of chargers requested. For example, if an applicant requests four (4) electric school buses and only two (2) chargers, their infrastructure incentive would be for a maximum of two (2) chargers. Applicants are encouraged to stack infrastructure funds with eligible sources of outside funding, such as utility and local air district programs.

No, for every (1) ZESBI awarded school bus, applicants can receive up to (1) ZESBI awarded charger. The amount of the infrastructure incentive is determined by the type of charger an applicant selects (see Infrastructure Incentive Amounts Table). If an applicant opts out of purchasing a charger, then they become ineligible for funding that could apply to associated infrastructure costs.

Applicants will be prioritized according to the following:

Tier 1 – Applicants defined as a small school district, or rural school district, or applicants serving a high percentage of unduplicated pupils (The LEA’s count of unduplicated pupils is 80% or greater of the total district enrollment as reported in CALPADS 2022-23 Fall Submission 1).

Tier 2 – Applicants that serve Disadvantaged Communities and/or Low-Income Communities

Tier 3 – All remaining eligible applicants located in the State of California

Applicants within each tier will be ranked based on the timestamp of submission of their complete Application Part A. Applications will be awarded on a first come, first served basis. The timestamp on any application that is missing materials or otherwise deemed incomplete will not be recorded until all application materials are submitted.

ZESBI requires that the eligible Local Educational Agency (LEA) complete all steps in the application process.

Eligible ZESBI costs must be incurred WITHIN the Effective Date of an Incentive Recipient’s Grant Agreement Term. Therefore, application assistance is not eligible for reimbursement.

The old school bus can be any internal combustion engine using any fuel type (gasoline, diesel, propane, or compressed natural gas). The following are the old school bus eligibility requirements:

- The school bus chassis must be a 2010 model year or older. The school bus chassis age is verified by the model year listed on the DMV Registration Form.

- The school bus must be applicant owned. The school bus cannot have a lienholder listed on the DMV Registration Form.

- The school bus must have a Gross Vehicle Weight Rating (GVWR) greater than 10,000 pounds. School bus(es) with a GVWR of exactly 10,000 pounds or less than 10,000 pounds are not eligible.

- The school bus must have a current California Highway Patrol Safety Certification (CHP 292 or equivalent) at the time of Application Part A submission. A non-certified school bus will not be able to continue within the application process.

- If a school bus is diesel-fueled and greater than 14,000 pounds GVWR, the school bus must be compliant with the California Truck and Bus Regulation in order to receive a full incentive amount. In cases where the old school bus is not compliant, a $20,000 incentive deduction will be applied per non-compliant school bus. Review the School Bus Fact Sheet on the Truck & Bus Regulation for detailed information: Truck & Bus Regulation – School Bus Requirements (ca.gov). Applicants will be asked to provide a self-certification that the school bus(es) are compliant. To maintain compliance with the CA Truck and Bus Regulation, school buses must have a diesel particulate filter (DPF) installed or operate less than 1,000 miles per calendar year (low use).

A lienholder will not prevent an eligible applicant from applying, however it can slow down the approval process significantly and, in some cases, can even prevent an applicant from receiving funding. Removing the lienholder can be a time-consuming process. Please refer to the State of California Department of Motor Vehicles website to learn more.

The old school bus must have a current California Highway Patrol Safety Certification (CHP 292 or equivalent) at time of Application Part A submittal. A non-certified school bus will not be able to continue within the application process.

New school buses must have Vehicle-to-Grid (V2G) functionality via use of type 1 combined charging system (CCS). This enables the new bus to engage in bi-directional charging capabilities such as storing and discharging electricity at a rate of at least 60kW, though there is no specific requirement for the purchaser’s utilization of this technology.

If an EV charger complies with the Requirements for EV Supply Equipment (EVSE) outlined in Section 7.2 of the California Energy Commission’s ZESBI Implementation Manual, the charger provider may fill out this Equipment Intake Form and email it with supporting documentation to the CALSTART School Bus Team ([email protected]). Upon receipt of the completed form, the School Bus Team will review the request and, if eligible, proceed with adding the new equipment to the Approved Product List (APL). Please note, to be eligible for ZESBI incentives, EVSE must be on the APL at the time the cost of the EVSE is incurred.

Upon approval of Application Part C, a grant agreement will be issued to the applicant. After the grant agreement is fully executed, the applicant will have 10 business days to sign and submit a purchase order or other binding agreement for the new school bus(es).

Through our CalFleet Advisor program, we can offer free technical assistance to help plan your next steps in school bus electrification and infrastructure installation. Our services include funding research, clarifying incentives, eligibility analysis, and application assistance. Other resources include relationship building referrals with utilities, OEMs, vendors and peers.

Get started by filling out the contact form. After your form is submitted, Cal Fleet Advisor will reach out to discuss how we can support your school bus fleet.

Generally, funds administered by local air districts or local municipalities, such as AB 923 funds, may be combined with ZESBI funding. Applicants may stack ZESBI funding with certain state funds only if the LEA has a small fleet. Some federal funding may be stacked with ZESBI. If an applicant chooses to stack with another incentive program, the LEA is responsible for ensuring that the other incentive program allows stacking with ZESBI and that all requirements of ZESBI and the other program are met.

ZESBI can be stacked with these funding programs administered by local air districts or federal entities with no restrictions on fleet size. Examples of stackable local and federal programs include:

- Federal Diesel Emissions Reductions Act State Grants or Rebates

- AB 923 Funds

- Sacramento Metropolitan AQMD’s Sacramento Emergency Clean Air & Transportation Grant Program (SECAT)

- South Coast AQMD’s Mobile Source Air Pollution Reduction Review Committee (MSRC) grants

- Bay Area AQMD’s Mobile Source Incentive Fund and Transportation Fund for Clean Air

ZESBI funding may be stacked with these state-funded incentives administered by local air districts only if the LEA has a fleet size of 20 vehicles of fewer:

- Carl Moyer Memorial Air Quality Standards Attainment Program (Carl Moyer Program)

- Community Air Protection Incentives to Reduce Emissions in AB 617 Communities

ZESBI funding cannot be stacked with either the EPA Clean School Bus Program or the EPA Clean Heavy-Duty Vehicles Program.

ZESBI participants may utilize the Department of General Services (DGS) Statewide Procurement Contract (Bulletin #: K-73-23). The Statewide Procurement Contract includes zero-emission school buses Type A, Type A with a cutaway chassis, Type C and Type D. Use of the DGS Statewide Procurement Contract is encouraged, but not required to receive ZESBI funding. To learn more about this opportunity, please go to: https://californiahvip.org/wp-content/uploads/2024/04/DGS-Statewide-Contract-Guide-Final.pdf

ZESBI participants may combine ZESBI funding with United States Internal Revenue Service (IRS) Tax Credits, such as the Qualified Commercial Clean Vehicle Credit. Tax-exempt organizations that buy a qualified commercial clean vehicle may qualify for a clean vehicle tax credit of up to $40,000 under the Internal Revenue Code (IRC) 45W. The tax credit is available for the year that the vehicle is put in service. The tax credit is for qualified commercial vehicles acquired after December 31, 2022, and before January 1, 2033. For more information, please visit https://www.irs.gov/credits-deductions/commercial-clean-vehicle-credit.

ZESBI participants can also claim up to a $100,000 tax credit for infrastructure through the Alternative Fuel Vehicle Refueling Property Credit (IRS Section 30C). For more information, please visit: Alternative Fuel Vehicle Refueling Property Credit | Internal Revenue Service (irs.gov) or contact the IRS directly.

It is imperative to the success of your project to provide timely responses to the ZESBI Team. The quicker applicants can resolve questions and/or document corrections, the quicker projects can move forward. Applicant correspondence from the ZESBI Team is sent from the CALSTART School Bus Team ([email protected]). Please make sure to add this contact to your email to ensure you do not miss any correspondence.

If at any stage in the ZESBI application or funding process, an applicant ceases to respond to CARB or its administrators for a period beyond 10 business days, funding may be cancelled and reallocated to another applicant.